Syncrasy in Insurance

Rapid digitization, changing customer expectations and shifting demographics are putting immense pressure on insurers. Explore why Syncrasy’s Data Discovery Platform is essential to underpinning modern data driven initiatives

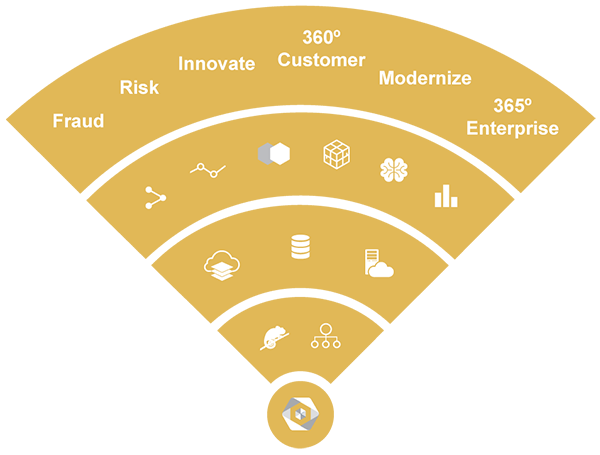

Syncrasy Data Discovery Platform

Powering transformational change

Hover over our icons to see how Syncrasy transforms challenges into opportunities

The challenges

The fight against insurance claims fraud, risk exposure reduction and the need to drive profitable growth through deeper customer insights and closer customer interactions are forcing insurers to rethink their data management strategy.

Traditional data silos frustrate efforts to get the right information at the right time, and the inability to blend and analyze all types of data from any source, in any amount and for any workloads poses a major threat.

Building modern data driven insurance solutions from scratch is NOT an option! Piecing together individual bits of proprietary and open source technologies is costly, time consuming and by the time you’ve finished requirements, data types and data volumes have changed; and architecting solutions built around a single database and data processing technology limits agility.

Syncrasy’s Data Discovery Platform alleviates these pressures and provides insurers with the foundation to retain massive amounts of diverse data and deploy the extensible technologies needed to keep pace with, and get ahead of, the digital race.

Syncrasy UI

Identity Management & Access Control

Syncrasy’s Enterprise Platform UI integrates a set of cloud-native UI technologies that deliver centralized access control to all Syncrasy Applications, as well as delivering comprehensive user management with the ability to connect to enterprise security systems including active directory and LDAP.

Syncrasy’s Chameleon Technology

Automating Application Plug-ability

All enterprises are unique and need unique solutions aimed at optimizing the value generated from their data.

Syncrasy’s Chameleon Technology allows solution designers to choose a vast range of pre-integrated applications, from managing connections to different data types to curating data motion through to managing data at rest and enabling data discovery.

Syncrasy’s API-Centric Architecture

Control, Security & Extensibility

Syncrasy’s embedded API Gateway is a scalable, open source-based API layer that runs in front of any RESTful API and is extended through plugins which provide extra functionality and services beyond the core platform.

Plugins are one of the most important features of Syncrasy’s API Gateway, with many features including authentication, rate-limiting, transformation, logging etc.

Almost all plugins can be customized not only to target a specific proxied service, but also to target specific Consumers.

Red Hat Virtualization

Open, scalable virtualization

Red Hat® Virtualization is an open, software-defined platform that virtualizes Linux and Microsoft Windows workloads.

Featuring management tools that virtualize resources, processes, and applications, it provides a stable foundation for Syncrasy’s Data Discovery Applications and a cloud-native - containerized future.

Red Hat Hyperconverged Infrastructure

Integrated software-defined compute and storage in a compact footprint

Red Hat® Hyperconverged Infrastructure offers an alternative to standalone Machine Virtualization by providing co-located, scalable, software-defined compute and storage on economical, industry-standard hardware. Reducing the number of physical servers required, lowering your costs and simplifying your infrastructure.

Red Hat Ceph Storage

A platform for petabyte-scale storage

Red Hat® Ceph Storage is an open, massively scalable storage solution for modern workloads like Syncrasy’s Data Discovery Platforms, media repositories, and backup and restore systems.

Red Hat OpenShift Container Storage

Storage for hybrid cloud and multicloud container deployments

Red Hat® OpenShift® Container Storage is software-defined storage for containers. Engineered as the data and storage services platform for Red Hat OpenShift, Red Hat OpenShift Container Storage helps deploy Syncrasy’s Applications quickly and efficiently across clouds.

Red Hat OpenShift

Efficiency, consistency, agility, & speed

Deployed on Red Hat® OpenShift® Kubernetes Container Platform running on Red Hat Hybrid Cloud infrastructures and any certified cloud provider, Syncrasy Data Management, Data Intelligence and Data Science solutions run with efficiency, consistency, agility, & speed across hybrid cloud and multicloud environments.

Syncrasy Connect

Pluggable Connectors for Any Data

Quickly, easily and reliably collecting, moving and exporting massive amounts of structured and unstructured data into and out of the Syncrasy Platform components.

Connect to:

- Enterprise Applications

- Relational Databases, Hadoop, NoSQL Databases

- Enterprise Data Warehouses

- Transactional Text, CSV, Excel Data

- Social Media Text, Audio, Video

- Machine Sensor and IoT Device Data

Syncrasy Dataflow

Modern Data Pipeline Engineering

Syncrasy Dataflow provides the ability to curate, mediate, change, parse, filter, join, merge, transform and enrich your data using multiple pre-engineered data pipelines uniquely designed for each use case.

Equally well designed for small scale data sources that make up the Internet of Things as well as large scale enterprise integration, Syncrasy’s Dataflow technologies allow enterprises to respond quickly and easily to new information requirements and build digital business disruptors.

Syncrasy Data Store

Pluggable Database Technologies

Syncrasy’s Open Data Architecture enables multiple best of breed databases to be tightly integrated and easily interchangeable according to application needs. Relational or Not, Structured or Not, Syncrasy provides enterprises with solutions that can quickly and affordably adapt to modern world requirements.

The following list is indicative of the range of databases that can be incorporated into a Syncrasy Solution:

- PostgreSQL

- CitusDB

- Crate.io

- Greenplum

- EdgiStore

- YugabyteDB

- MongoDB

- Redis

- MS SQL Server

- MySQL

Syncrasy Data Virtualization

Accelerating Data Availability

Syncrasy’s Data Virtualization provides a modern data layer that makes your data easy, approachable, and interactive, no matter how many terabytes, no matter where it's stored.

Users get controlled, secure and GDPR compliant data delivery to their favourite BI and data science tools from data housed throughout and beyond the enterprise.

Whether your data is located in your “Single Source of Truth” Data Store or held in underlying application databases, accelerate your favourite BI & Analytics Tools & by securely integrating all of your data.

Syncrasy Analytics & Data Science

Automated Machine Learning

DataRobot captures the knowledge, experience, and best practices of the world’s leading data scientists, delivering unmatched levels of automation and ease-of-use for machine learning initiatives.

Syncrasy’s integration of the DataRobot Platform enables users to build and deploy highly accurate machine learning models in a fraction of the time it takes using traditional data science methods.

With 5 easy steps, executives, business analysts and IT professionals can deliver predictive insights within hours, not months.

Syncrasy Data View

Self-Service BI & Analytics

A data driven business needs to empower everybody, from C-level executives to frontline workers with intelligence from data to make smart business decisions.

Data View not only simplifies the process for analysts and data scientists, it also enables “citizen developers” to self-serve to their best ability.

- Self-Service Analytics

- Rapid Design, Maximum Self-Service

- Quick, Iterative Mashup & Design - in a Single Web App

- Flexible Charts & Tables with Rich Visual Components

- Ad-Hoc Reporting and Scheduled Pixel-Perfect Reports

- Report Bursting to Large Audiences

- Parameterized, Personalized Reports

Enable new data-driven business models

Customers today expect more social and digital interaction and more individual attention, forcing insurers to rethink how insurance products are delivered.

Data driven innovations, such as usage-based insurance (UBI) programs as well as wearable fitness devices for heath insurance optimization are able to create new opportunities to either generate new revenues, provide better service, reduce operational costs or create market differentiation.

What insurance companies lack is a comprehensive 360º view of their customer and a Big Data IoT strategy. Syncrasy’s Big Data, IoT integration, data storage and analytics capabilities can cost-effectively underpin new, data driven, initiatives allowing insurers to continue to innovate, incentivize and retain customers.

Modernizing legacy systems

Proprietary data warehouses, outdated ETL systems, customer demands for new interactive line of business applications, digital invaders and increasing regulation are threatening insurers’ ability to compete and survive.

But replacing these systems on mass would be a major undertaking, thwart with risk, business disruption and potential failure.

An alternative would be to leverage the modern IT architecture of Syncrasy’s Data Discovery Platform to underpin, utilize and extend existing resources and position the enterprise with the IT infrastructure needed to address new data driven initiatives and be future ready.

Driving profitable growth through deeper customer insights

In an increasingly customer-centric world, the ability to capture and use customer insights to shape products, solutions and improve the buying experience is critical.

But for most insurers building a comprehensive customer profile from isolated in data silos, application platforms and customer interaction points is often out of reach.

Syncrasy’s Data Discovery Platform overcomes these obstacles by providing the data architecture and data processing capabilities to consolidate and correlate vast amounts of customer operational data to unlock the patterns that help identify customer needs, learn from their behaviors and deliver personalized interactions.

Risk management and regulatory compliance

Advancing regulation in the insurance industry now require insurers to hold capital in relation to their risk profiles in order to guarantee that they have enough financial resources to withstand financial difficulties.

Out of date ETL systems and legacy data warehouses however are hindering efforts by risk assessment teams to understand whether available data is current, accurate and comprehensive.

With Syncrasy’s Pluggable data curation, analysis, analytics and machine learning applications, insurers can build multiple data pipelines from the trusted “single source of truth” to:

- Improve the quality and accuracy of operational data.

- Satisfy regulatory and audit requirements.

- Use self-service analytics to improve risk assessments and profitability.

- Develop machine learning algorithms to cross correlate relationships and predict risk scenarios.

- Deliver timely reports to all information consumers.

Insurance fraud continues to rise

Global insurance fraud approximates to $100 Billion a year.

Whilst insurers seek to prevent fraud by analyzing current and historic data, the evolution and complexity of fraud schemes has made existing methods of detection and prediction mechanisms based on subsets of data obsolete.

Syncrasy’s Data Discovery Platform supports a new generation of detection and prediction mechanisms by providing the data architecture and data processing capabilities to consolidate and correlate vast amounts of historical claims data with new data sources, including social media content, clickstreams, web log data and others for real-time detection of fraud and identification of fraudulent patterns.

The importance of a 365º Enterprise View

Specialized insurance company line of business applications underpin essential day to day operations but typically record data in proprietary and diverse databases making it difficult to cross correlate data.

Legacy DataMart's and ETL systems have helped to aggregate summarized data from multiple applications, but running on expensive proprietary storage platforms these systems are difficult to scale and don’t accommodate today’s types and volumes of data.

Syncrasy’s Data Discovery Platform overcomes these issues by providing the data architecture to quickly, easily and reliably collect, curate, transform, enrich and aggregate ANY data from ANY source.

With the ability to store more data for longer, within and across geographic boundaries, insurers can build true 365º enterprise intelligence.

The Challenge

The fight against insurance claims fraud, risk exposure reduction and the need to drive profitable growth through deeper customer insights and closer customer interactions are forcing insurers to rethink their data management strategy.

Traditional data silos frustrate efforts to get the right information at the right time, and the inability to blend and analyze all types of data from any source, in any amount and for any workloads poses a major threat.

Building modern data driven insurance solutions from scratch is NOT an option! Piecing together individual bits of proprietary and open source technologies is costly, time consuming and by the time you’ve finished requirements, data types and data volumes have changed; and architecting solutions built around a single database and data processing technology limits agility.

Syncrasy’s Data Discovery Platform alleviates these pressures and provides insurers with the foundation to retain massive amounts of diverse data and deploy the extensible technologies needed to keep pace with, and get ahead of, the digital race.

The insurance industry foundation is based on measuring risk of events and controlling fraud. The access to massive enterprise datasets and the ability to analyze great volumes in real-time utilizing Big data technologies is redefining the industry’s foundation on data centricity.

Insurance fraud continues to rise

- UK – ABI estimates that insurance fraud costs 2.1 billion per annum.

- France – FFSA estimates that fraud accounts for 3.9 billion per annum and that instances of fraud have increased by over 16% year on year.

- South Africa – 1/3 of all insurance claims were considered fraudulent by the SAICB and cost the industry 15 billion rand (GBP 700 million).

- USA – CAIF report that Insurance fraud cost the industry over USD 80 billion each year.

- Spain – Insurers are reporting that whiplash claims are being pursued through the civil court rather than the usual criminal route. This utilizes private medical experts rather than court appointed advisors and has resulted in significant increases in both damages and fraud exposure.

Clyde & Co Global Fraud Survey

Whilst insurers seek to prevent fraud by analyzing current and historic data, the evolution and complexity of fraud schemes has made existing methods of detection and prediction mechanisms based on subsets of data obsolete.

Syncrasy’s Data Discovery Platform supports a new generation of detection and prediction mechanisms by providing the data architecture and data processing capabilities to consolidate and correlate vast amounts of historical claims data with new data sources, including social media content, click streams, web log data and others for real-time detection of fraud and identification of fraudulent patterns.

Syncrasy’ integration of powerful machine learning, graph, statistics and analytics engines, built to take advantage of modern computing capabilities, substantially improve detection and prediction methods with advanced data science tools.

Risk management and regulatory compliance

Advancing regulation in the insurance industry including the Solvency 2 directive (amended by the Omnibus 2 directive), requiring European insurers and reinsurers from the 1st January 2016 to hold capital in relation to their risk profiles in order to guarantee that they have enough financial resources to withstand financial difficulties, is forcing insurance companies to reassess their data management strategies.

Deployment of multiple policy and product line of business systems, industry mergers, consolidations and acquisitions, out of date ETL systems and legacy data warehouses are all hindering efforts by risk assessment teams to understand whether available data is current, accurate and comprehensive. This lack of reliance on the data generates the potential for losses through miscalculation of risk and regulatory non-compliance through inaccurate capital allocations.

Using Syncrasy’s Data Discovery Platform insurers can integrate and harmonize massive amounts of data from all data sources into an accurate and timely single source of truth. With all data consolidated into highly performant data structures, running on cost effective, infinitely and linearly scalable compute power and software defined storage systems, insurers can confidently manage and govern their data.

With Syncrasy’s Pluggable data curation, analysis, analytics and machine learning applications, insurers can build multiple data pipelines from the trusted “single source of truth” to:

- Improve the quality and accuracy of operational data.

- Satisfy regulatory and audit requirements.

- Use self-service analytics to improve risk assessments and profitability.

- Develop machine learning algorithms to cross correlate relationships and predict risk scenarios.

- Deliver timely tabular and graphical reports to all information consumers.

Enable new data-driven business models

Customers today expect more social and digital interaction and more individual attention, forcing insurers to rethink how insurance products are delivered.

Data driven innovations, such as usage-based insurance (UBI) programs including Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), as well as tracking wearable fitness devices for heath insurance optimization are able to create new opportunities to either generate new revenues, provide better service, reduce operational costs or create market differentiation.

What insurance companies lack is a comprehensive 360º view of their customer and a Big Data IoT strategy.

Many insurers find providing coverage to be cost-prohibitive and difficult to support due to operational and IT infrastructure constraints. Syncrasy’s Big Data, IoT integration, data storage and analytics capabilities can cost-effectively underpin these new, data driven, initiatives allowing insurers to continue to innovate, incentivize and retain customers.

However, whilst consumer IoT devices will proliferate in the future, millions of IoT devices are already deployed in a multitude of insurable industry sectors, including Aerospace, Chemicals, Pharmaceuticals, Energy, Petroleum, Agriculture and Manufacturing to name just a few. This market that is largely untapped by insurers from an IoT perspective, albeit that monitoring, analyzing and predicting risks from data supplied by industrial IoT devices offers the same opportunities to insurers as tracking consumer IoT devices, perhaps more.

Syncrasy’s Big Data and IoT integration, data storage and analytics capabilities can also be leveraged to create market differentiating insurance products to industries, potentially leading to spinoff IoT monitoring and alerting revenue generating services from the same infrastructure.

Driving profitable growth through deeper customer insights

In an increasingly customer-centric world, the ability to capture and use customer insights to shape products, solutions and improve the buying experience is critical.

But for most insurers building a comprehensive customer profile from isolated in data silos, application platforms and customer interaction points is often out of reach.

Few insurers can accurately correlate acquisition, cross-sell or upsell success with either their marketing campaigns or customer online browsing behavior.

Syncrasy’s Data Discovery Platform overcomes these issues by providing the data architecture and data processing capabilities to consolidate and correlate vast amounts of customer operational data, call center interactions, emails, social media and website interactions to unlock the patterns that help identify customer needs, learn from their behaviors and deliver personalized interactions.

With the ability to store more data for longer and identify distinct phases in customers’ lifecycles coupled with predictive analytics capabilities, insurers can build true customer 360º intelligence to help acquire, grow and retain the customers.

Syncrasy enables organizations better understand their customers, learn from their behaviors and deliver personalized interactions.

Modernizing legacy systems

Proprietary data warehouses, outdated ETL systems, customer demands for new interactive line of business applications, digital invaders and increasing regulation are threatening insurers’ ability to compete and survive.

But replacing these systems on mass would be a major undertaking, thwart with risk, business disruption and potential failure.

An alternative would be to leverage in phases the modern IT architecture of Syncrasy’s Data Discovery Platform to underpin, utilize and extend existing resources.

Syncrasy's Data Discovery Platform

Syncrasy’s Platform Core with Run Anywhere Technology, fully optimized for bare metal, virtualized, cloud or hybrid infrastructures, significantly reduces deployment time and costs, whilst at the same time maximizing the flexibility to start with a minimum investment and expand as required. This fault-tolerant, distributed and extensible by design architecture with modern, highly-available and load balanced cluster and datacenter resource scheduling and processing, is elastically scalable both at the application and compute resource deployment level.

Syncrasy’s COTs based Software Defined Storage Solution provides a low cost, highly scalable option to store new data types and volumes, whilst at the same time allowing the re-utilization of existing legacy storage infrastructure.

Syncrasy’s Virtualization Technology provides a lightweight, low overhead, low cost alternative to full machine virtualization with high availability, live migration, automatic backup and restore for both modern cluster based applications as well as existing line of business applications running on legacy databases and operating systems.

Syncrasy’s Chameleon Technology, simplifies the plug-ability of modern, data centric applications and positions insurers with the IT infrastructure to address future ready, data driven initiatives.

The importance of a 365º Enterprise View

Specialized insurance company line of business applications (product, policy & agent management, billing and payments processing, CRM, ERP, HR and BI systems) underpin essential day to day operations, marketing and management processes.

However, line of business applications typically record data in proprietary and diverse databases making it difficult to cross correlate enterprise data.

Legacy DataMart's and ETL systems have helped to aggregate summarized data from multiple applications but running on expensive and proprietary storage platforms these systems required predesigned architectures and sizing, making them difficult to scale. Today’s volumes and types of data don’t fit well into these legacy architectures and constrict insurers’ capabilities to build rich and in-depth Enterprise Views.

Syncrasy’s Data Discovery Platform overcomes these issues by providing the data architecture to quickly, easily and reliably collect, curate, transform, enrich and aggregate ANY data from ANY source, load the data into modern data architectures according to business needs and then analyze and visualize the cross enterprise data.

With the ability to store more data for longer, within and across geographic boundaries, insurers can build true 365º enterprise intelligence.

See the big picture. Talk to us.

Syncrasy’s Transformational Technologies

Syncrasy’s Platforms integrate preselected best-of-breed open technologies that are vetted, tested and pre-engineered to provide the foundation and solution building applications needed to build early wins, explore opportunities and generate a “Flywheel Effect” that powers enterprise wide digital transformation.